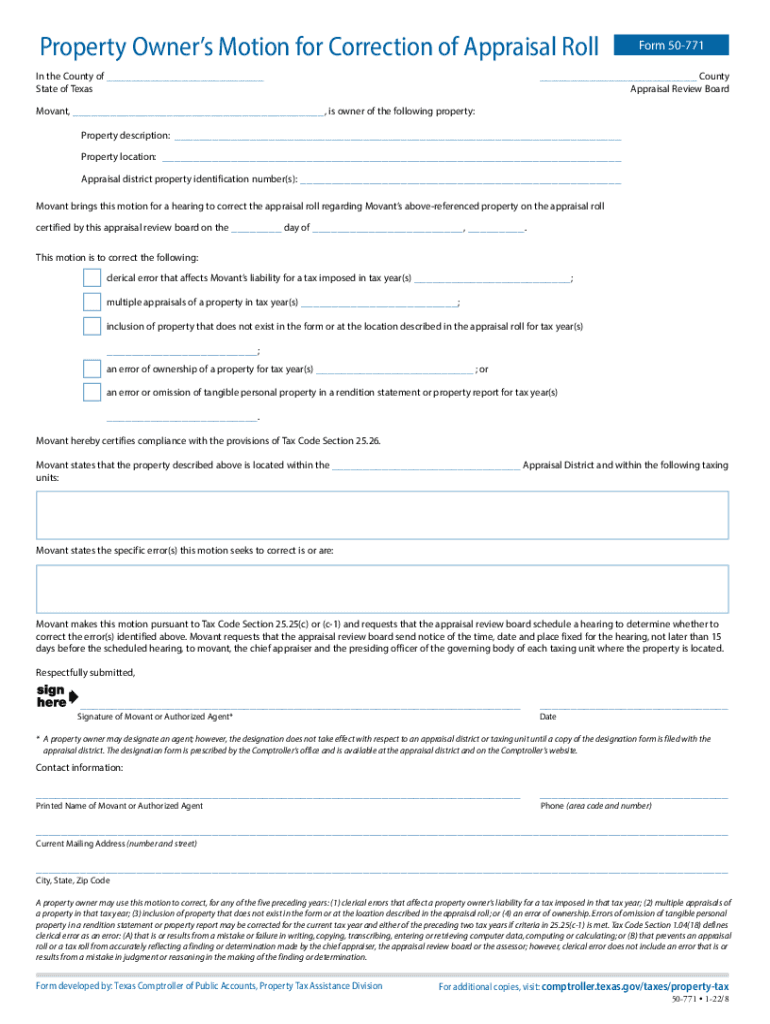

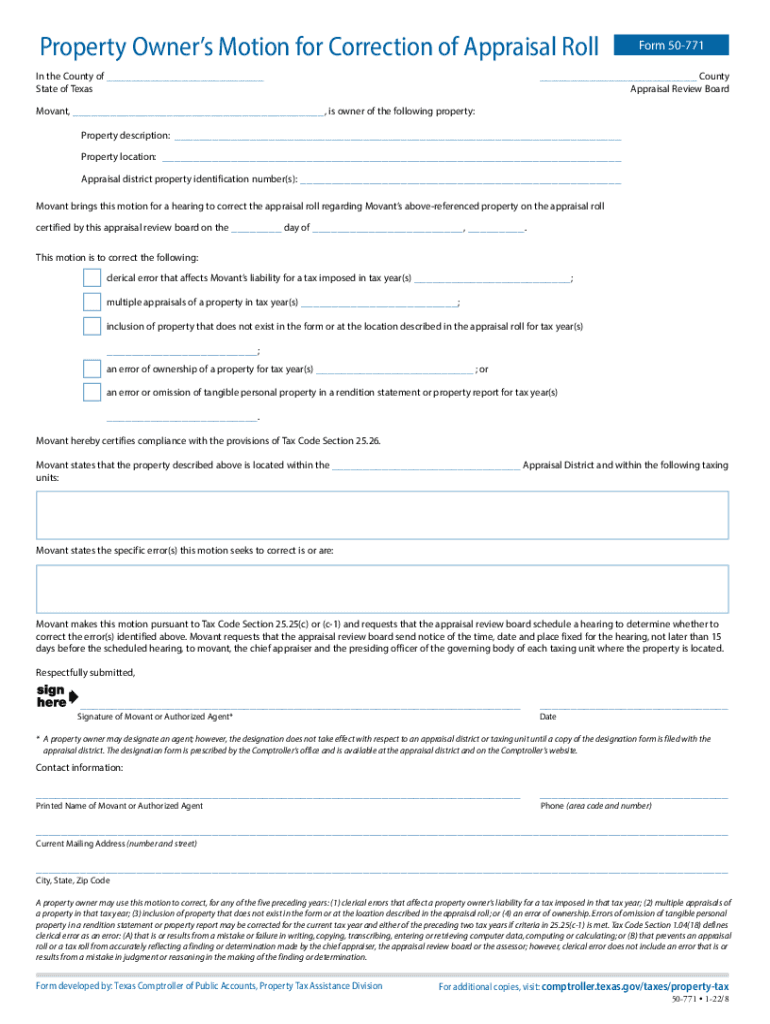

TX TAD 50-771 (formerly TARB 6600 & 6106) 2022-2024 free printable template

Get, Create, Make and Sign

How to edit texas comptroller roll online

TX TAD 50-771 (formerly TARB 6600 & 6106) Form Versions

How to fill out texas comptroller roll 2022-2024

How to fill out Texas Comptroller roll:

Who needs Texas Comptroller roll:

Video instructions and help with filling out and completing texas comptroller roll

Instructions and Help about property motion correction form

Hey guys welcome to another video as always I'm a little late to the party today were gonna check out how to mod socket 771 to make them work in a socket 775 motherboards I've always been aware of this modern there are heaps of guides out there already I got interested into socket 775 because the prices for boards and chips are really cheap at the moment so its cheap enough to just have fun socket 775 might not be the latest and greatest platform anymore but for older games and using it as a basic Windows system or Linux whatever, and it will do the job just fine now I'm especially interested in the higher-end processes for example an extreme edition core 2 quads can still cost between 100 and 200 dollars, so they're still quite expensive, but you can get an equivalency inversion for 14 harm of the original price basically so to prepare for this video I bought quite a few Sean processes of AliExpress and this one might be very interesting model its clocked at 3 gigahertz it's got 12 megabyte caches and FSB of 1333 but its low power its it has a TDP of only 80 watts, so this processor might be a perfect overclocked now this chip is not modern, so we will modding this one now if modding is not your thing or have some perfect news out of all the chips I bought all of them are pretty much promoted already so if you not into filing or cutting you can still get on board with all these seen stuff, so you can see we've got some notches here on the bottom but also here on the sides and if we flip it around we can see this one has a sticker the other processes are the same thing it had some modification on the outer sides of the casing and if we flip it over this one has a slightly different type of mod and prices are fairly identical, so it might just be a few dollars more to get a moderate processor rather than one that you need to mount yourself and the easy to spot often the photo has the modification shown like this the models be a text on the photo saying something no need adaptor or something like that and some people have some sell us on eBay all Express have a photo where you can see the modification around this area, and we will do both just in case you are eager to do the mod yourself it's not that difficult but from my point of view I rather spend a few dollars more and get a chip that's already been modified the other good news is if you're not into BIOS modding we need to inject some microcode so that these human processes will get properly detected if you're not into that there are eBay sellers that offer service you basically contact them tell them what motherboard you have, and they will sell you for a dollar a modified bias that you just have to flash, and then you're good to go, so let's have a look how this mod works here we've got an LGA 775 motherboard this is not the port were gonna later use this is a generic internal motherboard basically just for testing if I stuff anything up I'm not too fast so here we have got the LGA 775...

Fill tx owner correction form : Try Risk Free

People Also Ask about texas comptroller roll

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your texas comptroller roll 2022-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.