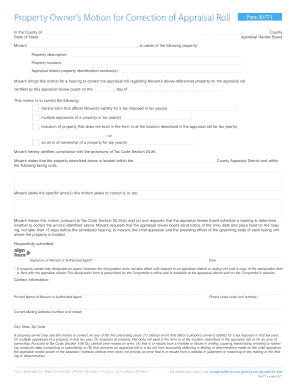

TX TAD 50-771 (formerly TARB 6600 & 6106) 2022-2026 free printable template

Show details

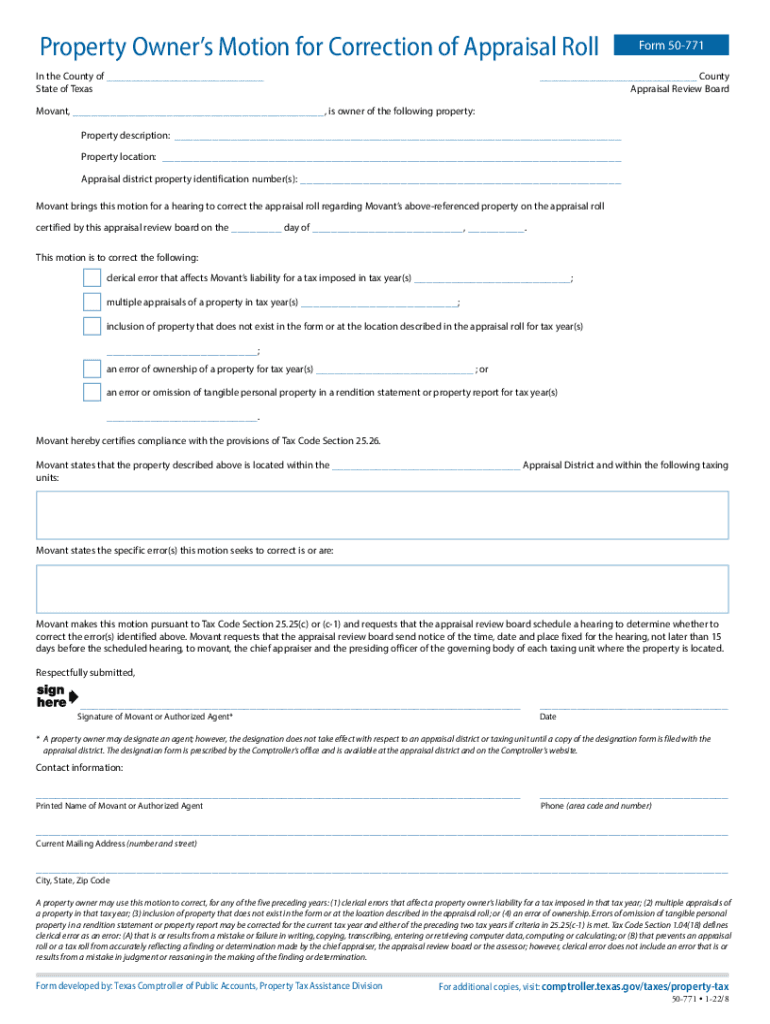

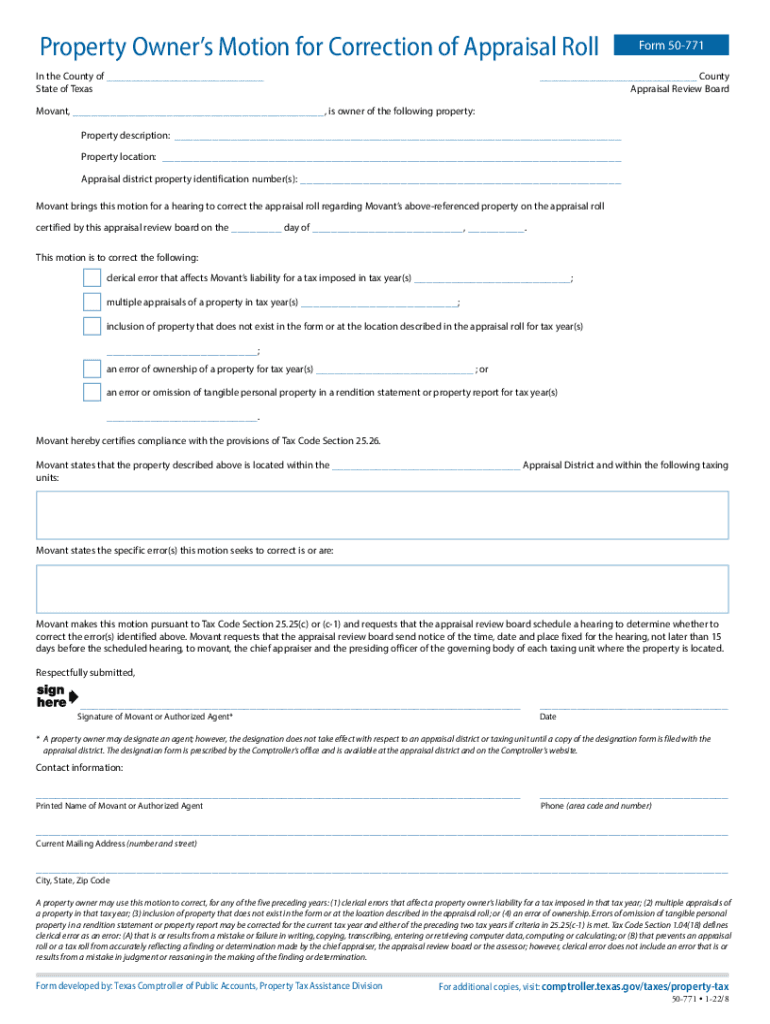

This document is intended for property owners in Texas to request a correction in the appraisal roll due to various errors affecting their property tax liabilities.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 50 771 form

Edit your texas property motion form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 50 771 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas comptroller roll online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit texas 50 motion form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX TAD 50-771 (formerly TARB 6600 & 6106) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out texas property motion form

How to fill out TX TAD 50-771 (formerly TARB 6600 &

01

Obtain the TX TAD 50-771 form from the Texas Alcoholic Beverage Commission website or your local TABC office.

02

Read the instructions carefully to understand the purpose and requirements of the form.

03

Fill in the applicant's name, address, and contact information at the top of the form.

04

Provide the requested details about the type of alcohol permit you are applying for.

05

Include any relevant business information, such as the business name and location.

06

Sign and date the application to certify that the information provided is accurate.

07

Submit the completed form to the appropriate TABC office along with any required fees and supporting documentation.

Who needs TX TAD 50-771 (formerly TARB 6600 &?

01

Individuals or businesses looking to obtain a permit for the sale or distribution of alcoholic beverages in Texas.

02

Establishments such as bars, restaurants, and liquor stores that require proper licensing to operate legally.

03

Anyone renewing their previous alcohol permit or changing their business structure and needing to reapply.

Fill

texas 50 771 blank

: Try Risk Free

People Also Ask about tx 50 771 motion correction fill

Is it worth protesting property taxes in Texas?

Consequently, as a homeowner, you're likely to pay more taxes than what is fair at some point. That's a reason to protest your tax appraisal in Texas. Statistics from Dallas County in Texas reveal that about 50% of tax protests are usually successful and that those who protest typically save an average of $600.

Is it legal to increase property taxes 10% in Texas?

State law limits the taxable value of an owner's primary residence from rising more than 10% in a given year.

Is there a limit on how much property taxes can increase in Texas?

The appraised home value for a homeowner who qualifies his or her homestead for exemptions in the preceding and current year may not increase more than 10 percent per year.

How much can appraised value increase in Texas?

Technically, a Texas homestead's assessed value is limited to the lesser of either its market value or the sum of the market value of any new improvements and 110% of the appraised value of the preceding year. The 10% increase is cumulative.

What evidence do I need to protest property taxes in Texas?

You should gather all information about your property that may be relevant in considering the true value of your home such as: Photographs of property (yours and comparables) Receipts or estimates for repairs. Sales price documentation, such as listings, closing statements and other information.

What is the difference between market value and appraised value in Texas?

The county appraisal district (CAD) sets a value on your property annually. That is the appraised value. Since all CADs are required to appraise properties at market value, theoretically then, appraised value is the same as market value.

Do you pay taxes on market value or appraised value Texas?

Generally, all property must be taxed based on its current market value. That's the price it would sell for when both buyer and seller seek the best price and neither is under pressure to buy or sell.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find texas motion correction appraisal?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the forma 589 i. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in texas 50 771 property motion?

With pdfFiller, the editing process is straightforward. Open your tx property correction appraisal sample in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete tx comptroller correction roll pdf on an Android device?

On an Android device, use the pdfFiller mobile app to finish your texas owner correction form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is TX TAD 50-771 (formerly TARB 6600)?

TX TAD 50-771 is a form used for the appraisal district in Texas to report information regarding property values and characteristics for tax assessment purposes.

Who is required to file TX TAD 50-771 (formerly TARB 6600)?

Property owners and entities that own taxable property in Texas are required to file TX TAD 50-771 if they want to contest their property appraisals or report specific property information.

How to fill out TX TAD 50-771 (formerly TARB 6600)?

To fill out TX TAD 50-771, one must provide accurate details about the property including legal descriptions, ownership information, property characteristics, and any supporting evidence for their claim.

What is the purpose of TX TAD 50-771 (formerly TARB 6600)?

The purpose of TX TAD 50-771 is to facilitate the appeals process for property owners who believe their property's appraisal value is incorrect, ensuring accurate property tax assessments.

What information must be reported on TX TAD 50-771 (formerly TARB 6600)?

The information that must be reported includes the property owner's details, the property's legal description, current and proposed appraised values, and any relevant documentation that supports the appeal.

Fill out your TX TAD 50-771 formerly TARB 6600 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Comptroller Correction is not the form you're looking for?Search for another form here.

Keywords relevant to tx property motion sample

Related to read the instructions carefully to the top of the form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.